Master Your Money Through Practical Learning

Our autumn 2025 programme brings together real expense tracking scenarios with hands-on financial management skills. You'll work through actual budgeting challenges that mirror what you face every day—not theoretical exercises that feel disconnected from reality.

Request Programme Details

What You'll Learn

Six Months of Structured Financial Growth

Starting September 2025, we guide you through building sustainable money habits. Each module connects to the next, creating a foundation that actually holds up when life gets messy.

-

01

Setting Up Your Tracking System

Find a method that works with your lifestyle—not against it.

-

02

Understanding Your Spending Patterns

Spot where money goes without judgement or shame.

-

03

Creating Flexible Budgets

Build plans that adapt when unexpected expenses show up.

-

04

Managing Irregular Income

Strategies for freelancers and anyone with variable pay.

-

05

Building Your Safety Net

Start small and grow your emergency fund at your own pace.

Programme Timeline

We run two intake periods annually. Applications for autumn 2025 open in June, with the programme starting mid-September and running through February 2026.

June 2025

Applications Open

Submit your interest form and tell us about your financial goals. We'll arrange a brief chat to see if the programme fits your needs.

15 September 2025

Programme Begins

Orientation week introduces you to the cohort and sets up your tracking tools. You'll meet your peer group and start gathering baseline data.

October-January

Core Learning Phase

Weekly sessions blend instruction with practical application. You'll work on your own finances while learning from others' experiences.

February 2026

Programme Conclusion

Review your progress and create a maintenance plan. Access to our alumni community continues for ongoing support.

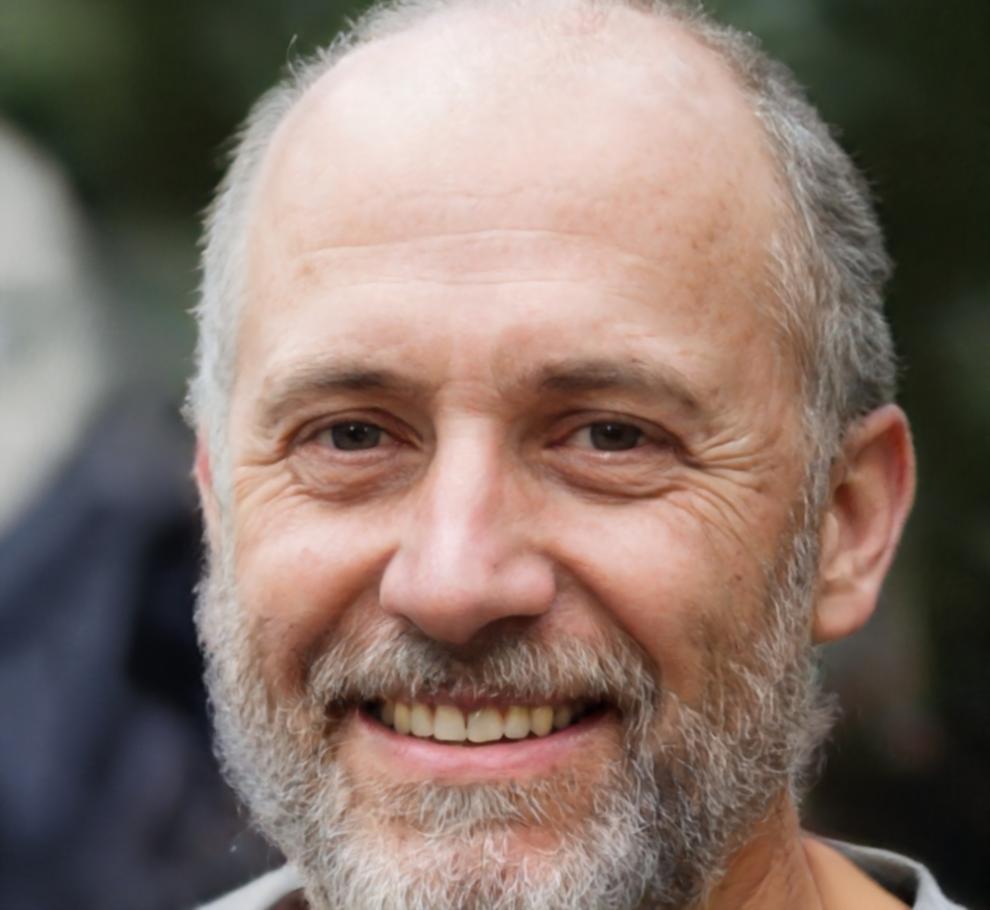

Desmond Kavanagh

Programme Coordinator

Spent fifteen years helping people untangle their finances after building his own system to get out of debt.

Riordan Fenwick

Workshop Facilitator

Former accountant who now teaches practical money skills in plain language without the jargon.

Learn From People Who've Been There

Both of us came to this work through our own struggles with money. Des dug himself out of credit card debt by creating tracking systems that actually worked. Riordan left corporate accounting because he kept seeing people who needed basic financial skills but couldn't access them.

We don't pretend this stuff is easy. But we do believe most people can manage their money better with the right tools and a bit of support. Our teaching style is straightforward—we show you what works, explain why it works, and help you adapt it to your situation.